By Karin Mizgala, BA Psyc, MBA, CFP®

Whether you believe in New Year’s resolutions or not, doing better with money in the coming year is probably on your mind. Why is it such a popular resolution, yet so hard to keep?

One of the biggest reasons is not having a clear sense of what financial success means to you. The other reason is that it’s just not easy to do what it takes to be good with money in the complex and busy culture we live in.

It takes less effort to hope that a windfall will suddenly appear or to just stay stuck in financial inertia, but wouldn’t it be nice to finally feel in control of your money once and for all – on your own terms?

Financial Well-being isn’t a function of having more money or being ultra-rich or keeping up with the Joneses. It’s defined as knowing that you are financially secure, that you have ‘enough’ now and in the future for the life that you envision for yourself and your family.

Financial Well-being isn’t a function of having more money or being ultra-rich or keeping up with the Joneses. It’s defined as knowing that you are financially secure, that you have ‘enough’ now and in the future for the life that you envision for yourself and your family.

‘Enough’ is a function of 1) having sufficient money to meet your current and future lifestyle needs (financial balance) and 2) feeling good about money (financial peace). It means both the numbers and your perception about money are positive and comfortable.

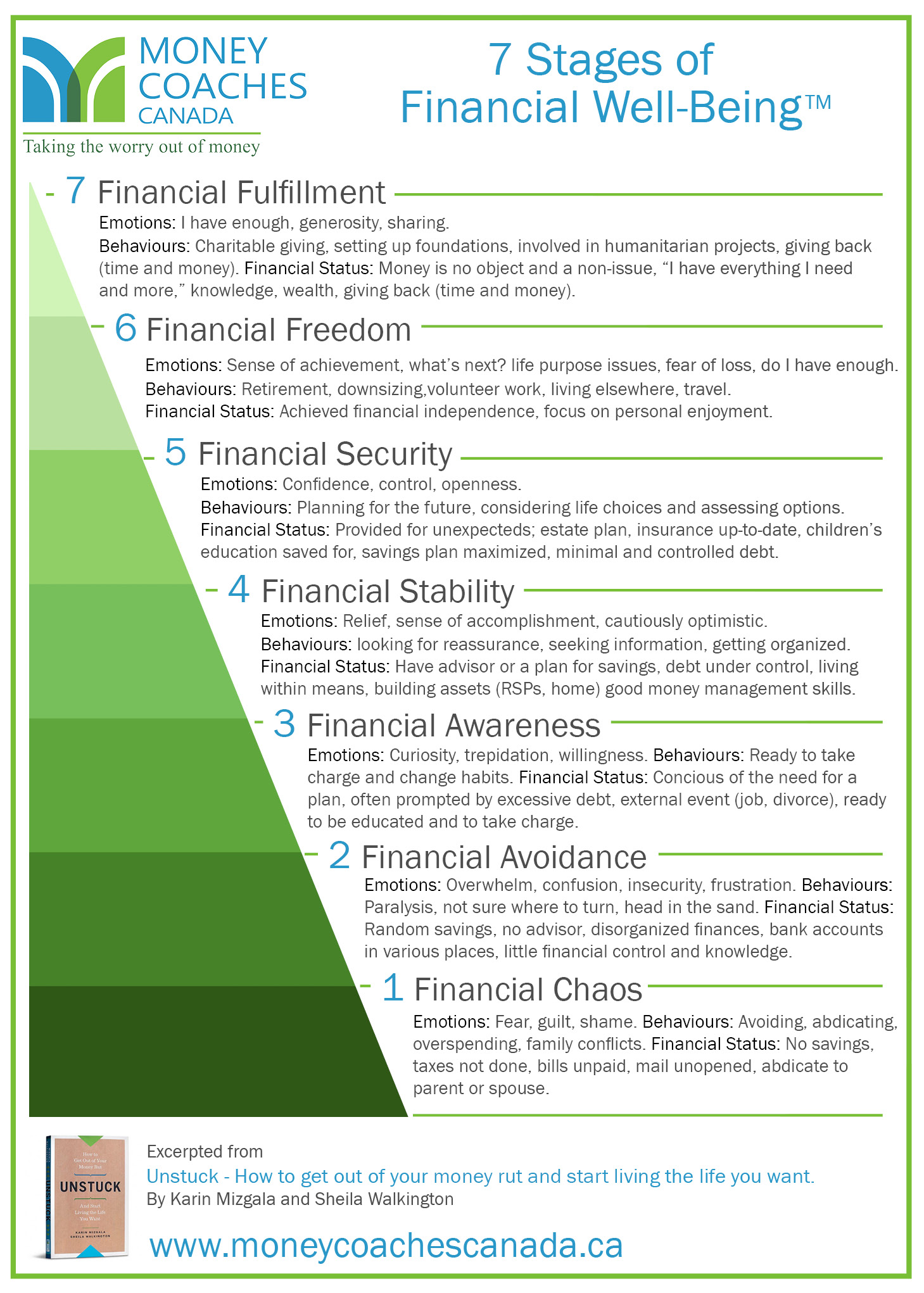

By using our 7 Stages of Financial Well-Being™ quiz you will get a sense of where you stand now on the journey to financial well-being and fulfillment. (Click here to download and take the quiz ). It will help you focus on the right things at the right time and will provide guidance on the best tools and resources for you to use to move step-by-step up the stages of Financial Well-Being.

Financial Well-Being comes with a deeper understanding of where you stand with money, emotionally and financially, developing concise and attainable goals, getting organized and implementing a manageable plan to move forward. It means measuring progress and staying committed to your goals.

Nope – not a quick fix. It requires patience, discipline and commitment – but it’s the only path to achieving true and lasting financial fulfillment.

Book a conversation with a Money Coach to create your customized planning, money management system and accountability program.