By Barbara Knoblach, PhD

Choosing the most optimal time to apply for Canada Pension Plan (CPP) benefits would be easier if you had a crystal ball to see into your retirement years; but with a bit of calculated foresight you can make a decision that suits your circumstances.

Choosing the most optimal time to apply for Canada Pension Plan (CPP) benefits would be easier if you had a crystal ball to see into your retirement years; but with a bit of calculated foresight you can make a decision that suits your circumstances.

Here’s a look at some basics:

Canada Pension Plan benefits can be drawn as early as age 60 (reduced 0.6% for each month before 65) or as late as age 70 (increased 0.7% for each month after 65).

The average life expectancy for Canadians is age 80 for men and 84 for women. Statistics Canada predicts a continued rise in life expectancy of roughly two years over the next 15 years.

Things to consider:

Life expectancy

Contemplating your mortality may feel uncomfortable, but your health and whether or not longevity is a family trait, are things to consider when making your decision.

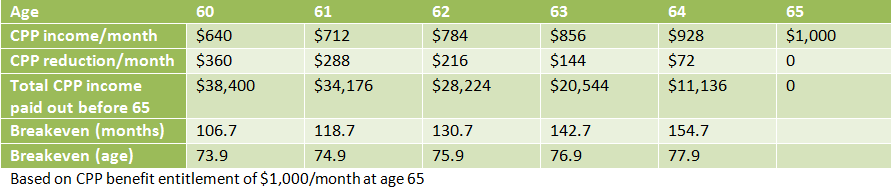

If you take your CPP starting at age 60, your breakeven point with someone who waits until age 65 is when you both turn 74. Confused? Let me put it another way; if Mary takes her CPP at 60 and Brenda takes hers at 65, Mary’s monthly CPP payment will be 36% lower than Brenda’s, but she will collect five years longer. They will be 74 when Brenda pulls ahead of Mary for overall amount collected.

CPP Breakeven Point Chart (2016)

Working and collecting CPP

Working and collecting CPP

If you believe good genes are on your side and there is a strong chance you’ll be collecting CPP into your 80s, it may be beneficial to wait until age 70, but only if you can afford to do so. How much cash flow you have from other sources is as important a consideration as your health. If you are living on a restricted income it may be better to take CPP sooner and enjoy an improved quality of life while you are best able to appreciate it.

Even if you don’t retire at age 60 you are eligible to collect CPP, but you and your employer will still be required to make CPP contributions until age 65. If you are still working between ages 65 and 70 you are no longer required to contribute (whether you are collecting CPP or not), though you may choose to, thereby increasing your CPP benefits.

Even if you don’t retire at age 60 you are eligible to collect CPP, but you and your employer will still be required to make CPP contributions until age 65. If you are still working between ages 65 and 70 you are no longer required to contribute (whether you are collecting CPP or not), though you may choose to, thereby increasing your CPP benefits.

CPP benefit entitlements

It’s also important to understand how much CPP benefit you are entitled to before you decide the optimum time to collect.

As of 2016 the maximum benefit is $1,092.50 per month, but you might not qualify for the maximum. It all depends on how much you contributed over the course of your working life. According to the Government of Canada website the average amount new beneficiaries received at age 65 was $664.57 in 2016. If you would like to know how much you can expect to receive, you can request a statement of Contributions through your Service Canada account.

Ultimately the decision on when to apply for CPP should be part of a larger retirement plan. If you would like assistance creating a plan that supports the future you desire, contact one of our Money Coaches and get started.

This is very helpful, but I would like to see the chart extended to show the break even point for delaying until age 70.

We will be working on the numbers and posting an update shortly.